Related Jobs

View all jobsData Protection Officer - DUAL

Information Security Officer - Risk and Audit

Regulatory Compliance & MLR Officer, West Midlands

Risk and Compliance Manager

OT Security Officer

Get the latest insights and jobs direct. Sign up for our newsletter.

Industry Insights

Discover insightful articles, industry insights, expert tips, and curated resources.

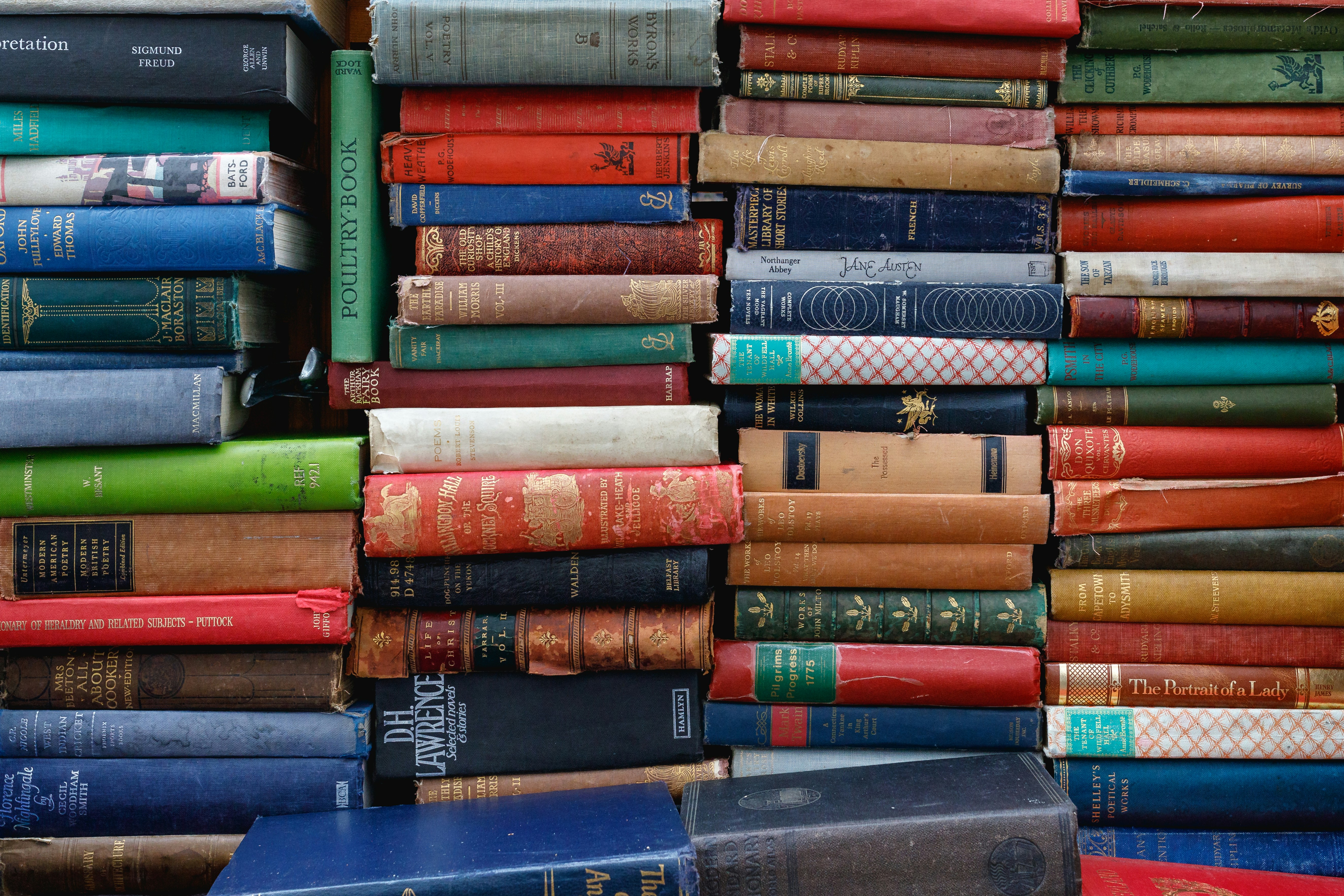

10 Must-Read Cyber Security Books for UK Professionals: Boost Your Career and Stay Ahead of Threats

With rapid advancements in digital infrastructure, cloud computing, and the Internet of Things (IoT), cyber threats continue to evolve at lightning speed. For organisations across the UK—and globally—robust cyber security is no longer optional: It’s a strategic imperative. From healthcare and finance to government agencies and tech start-ups, every sector needs skilled professionals to safeguard critical data and protect users. If you’re looking to break into or advance within the cyber security industry, staying updated on the latest techniques, threat landscapes, and defence strategies is paramount. One of the best ways to build and sharpen your expertise is by reading authoritative, high-quality books that combine foundational knowledge with cutting-edge insights. In this guide, we’ve compiled a list of ten books that cater to various skill levels, spanning ethical hacking and threat intelligence to secure software development and cryptography. By diving into these resources, you’ll fortify your understanding of cyber security fundamentals, explore hands-on techniques for defending systems, and gain the strategic perspective needed to excel in roles throughout the UK’s thriving cyber security landscape.

Navigating Cybersecurity Career Fairs Like a Pro: Preparing Your Pitch, Questions to Ask, and Follow-Up Strategies to Stand Out

In a world where digital threats are escalating and online infrastructure underpins nearly every aspect of our personal and professional lives, cybersecurity has swiftly become one of the most sought-after career fields. Demand for skilled cybersecurity professionals outstrips supply, both in the UK and globally. From ethical hackers and penetration testers to governance, risk, and compliance (GRC) specialists, the opportunities are extensive—and lucrative. Amidst this surge in demand, cybersecurity career fairs provide an invaluable chance to meet potential employers face-to-face, gain industry insights, and make connections that can accelerate your career trajectory. Unlike applying to countless jobs online, these events bring companies, security leaders, and aspiring candidates together under one roof. When approached with the right strategy, a single conversation at a cybersecurity fair can open the door to your dream job. In this comprehensive guide, we’ll explore how to prepare thoroughly, engage confidently, and follow up effectively after a cybersecurity career fair. By incorporating these insights into your approach, you’ll stand out from the crowd and maximise your chances of securing the perfect role in this fast-growing field.

Common Pitfalls Cyber Security Job Seekers Face and How to Avoid Them

The cyber security industry in the UK and worldwide is experiencing rapid growth. With cyber attacks growing in sophistication and frequency, organisations are investing more resources than ever into defending their digital assets. From penetration testers and threat analysts to security architects and compliance officers, cyber security professionals are in high demand across a variety of sectors—including finance, healthcare, government, and retail. Yet, in spite of this high demand, the process of landing a cyber security role can be more challenging than many candidates anticipate. The stakes are high: prospective employers entrust cyber professionals with their most sensitive data, their compliance posture, and often their core business operations. Therefore, they’re looking for candidates who can demonstrate not just technical know-how, but also excellent communication, adaptability, and an awareness of the broader business context. In this article, we’ll explore the most common pitfalls that cyber security job seekers face, especially in the UK market, and how to avoid them. Whether you’re a recent graduate, a professional transitioning from a different field, or an experienced practitioner aiming for a senior role, these insights will help you stand out and secure the opportunities that fit your skill set and career goals.